Reducing Your or a Consumer’s Property Tax!

Also Is A Highly Rewarding Residential, Industrial, Industrial Property Tax Consulting Enterprise

In A Multi-Trillion Greenback Alternate

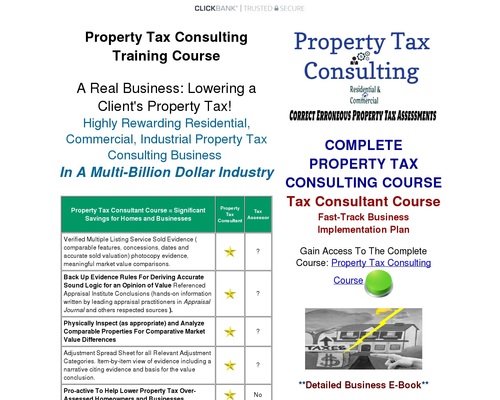

Property Tax Manual Direction = Principal Financial savings for Properties and Companies |

Property Tax Manual |

Tax Assessor |

|---|---|---|

| Verified More than one List Provider Provided Evidence ( comparable parts, concessions, dates and ethical equipped valuation) photocopy proof, indispensable market payment comparisons. |

|

? |

| Motivate Up Evidence Guidelines For Deriving Merely Sound Common sense for an Conception of Price Referenced Appraisal Institute Conclusions (fingers-on recordsdata written by leading appraisal practitioners in Appraisal Journal and others respected sources ). |

|

? |

| Bodily Explore (as acceptable) and Analyze Linked Properties For Comparative Market Price Differences |

|

? |

| Adjustment Spread Sheet for all Linked Adjustment Courses. Merchandise-by-item ogle of proof including a story citing proof and foundation for the payment conclusion. |

|

? |

| Pro-packed with life To Aid Decrease Property Tax Over-Assessed House owners and Companies |

|

No |

|

Scorecard |

5 STARS |

(Click on Right here)  Get entry to

Get entry to

Staunch Property Appraisal and Property Tax Manual Residential & Industrial Packages

Using Ultimate Staunch Property Market Valuation for residential and commercial firms must fair egregious over-assessed properties and tax overpayments due to

nasty municipal assessments.

Why such wide

over-evaluate errors? An ethical market valuation house appraisal costs

$300 to $450. Municipalities lack the

funding to conduct dear blanket reassessments for his or her territories.

The time spent per evaluate is minimal. Somewhat assuredly outdated assessments

are merely rolled over. Because every person wishes wait on, use our 5 step

project for presenting an ethical market valuation for your or a purchasers

house.

Aid others now not to over-pay, ethical pay the ethical property tax evaluate that they wishes to be charged. Your future purchasers are being squeezed ample, they like to NOT overpay! Consultants yell us that over-assessed properties excesses vary from 40% to 60% (click on underlined for verification).

It’s top to have the choice to present stop to-drag within the park steerage to purchasers in describe to pay exactly what they wishes to be charged, NOT OVER-PAY!

It’s step-by-step and you are encouraged to grasp on cases from the very starting build so that you just will build as you notice those particular adjustments to a disclose client.

With easy to admire coaching, it is potential so that you just can to wait on purchasers lower their tax and bid their file straight. In the project of helping the patron, you build gargantuan commissions. Lawful recordsdata:purchasers are easy to search out!

Home proprietor’s (and firms) when they bag their tax invoice are on occasion taken abet by the quantity charged! The reality is: Most DON’T KNOW that they are over-charged!

The over-assessed desperately want a Property Tax Assessment Review Provider that has their abet!

Right here’s a somewhat uncommon, under-the-radar miniature industry consultancy opportunity that sorely lacks practitioners. Earning potential would be sky-excessive. Customers are all over. That it is doubtless you’ll presumably presumably obtain that there is with regards to miniature to no competitors in most native house. It’s an ever-green strange industry and it be recession proof!

It helps customers who like a tax-good buy case shave-off severe sum of cash off their tax invoice. Any client who’s suspicious of their property tax welcomes your wait on.

If the property is over-assessed, your property tax good buy procedures wait on discontinuance in deserved tax breaks that are placed abet into the legend of that buyer. You emerge the hero and build an mavens earnings as a reward.

Evaluate the Residential and Industrial Property Tax Good deal Enterprise and Assign Charges with Your First Consumer

A rising numbers of householders and firms will doubt the accuracy of their assessments and desire to attraction their property taxes!

One more time, competitors is with regards to nil; there are more potential customers than you is probably going to love the ability to take care of. You build a excessive contingency price as a results of winning. You bag to wait on a potential house proprietor or industry lowering his/hers/their property tax.

Rectify a tax injustice and give the buyer the property tax destroy they deserve. In flip, you are rewarded out of that tax good buy by the use of a contingency price that might perhaps perhaps presumably raise over into subsequent years. Besides feeling wide about helping others, that is extremely lucrative.

This contingency carryover manner you is probably going to be rewarded a couple of cases for the the same hours of labor. Besides getting rewarded monetarily, you will revel in helping your client out of an unfair evaluate jam. Test out the project!

Package #1

(integrated in direction)

Pre-written, challenging to use

PRESENTATION FORMAT for every property tax attraction (a $19 Price)

Extremely Priceless Free house appraisal and property tax attraction kinds. The kinds are PDF downloadable and provide a generic template to arrange your recordsdata in a appropriate structure so that you just would existing your proof in lawful style. It’s identical to that susceptible by licensed real estate appraisers. You will be given the password to bag admission to this recordsdata at this time after your describe.

Package #2

(integrated in direction)

Pre-written, challenging to use

Your total pre-written kinds, letters, buyer contracts you will

ever must set industry ($599 + Price)

Beneficial Sample Price Agreement Sorts, Have In Price Agreement Fabricate, Sample Manual/Company Authorization Fabricate, Have In Manual/Company Authorization Sorts, Residential Solicitation Letters, Signed Contract Transmittal Letters, Thank You For Deciding on Our Firm Letters,

Dinky Vitality of Authorized reliable Fabricate, We Bear Filed Your Charm Letters, Invoice Fabricate For Services Rendered, Enclosed Is Your Invoice Letters, Past Due Ask Letters ….

Package #3

(integrated in direction)

Pre-written, challenging to use

Property Tax Manual Insiders Advertising and marketing Opinion ($500 + Price)

Beneficial Right here’s the elegant particulars for making this industry work. Your total programs, recommendation and ways you will must rapid-tune this industry. You uncover easy programs to bid up your industry and uncover easy programs to head about marketing your industry to a wide population of potential purchasers.

Package #4

(integrated in direction)

Pre-written, challenging to use

Updates for existence ($297 + Price)

Beneficial Reduction yourself up to this point with the most modern learn and property tax attraction recommendation for existence.

Package #5 (integrated in direction)

Pre-written, challenging to use

Persuasion Tactics & Persuasive Salescopy Guide 110 Pages …

($157 + Price)

Priceless It’s top to have the choice to bag your fingers on all of this payment, the product itself, the guarantee that you just will be overjoyed with the consequence, and my internal most assurance of wait on along with your industry whilst you occur to want it, plus if issues don’t figure out, the likelihood is all mine. How powerful are we speaking here?

No longer $500, now not $300, now not even $200, but integrated with our product, you would bag your fingers on the total bundle. Ultimate direct what having the the same insider info and expertise might perhaps perhaps presumably presumably set for you. (click on industry ways, persuasive for more detailed recordsdata)

Package #6

(integrated in direction)

Pre-written, challenging to use

Persuasion Gross sales Letters & Copywriting Direction 136 Pages … ($97 + Price)

Priceless The Vitality Of Words Can Produce You Rich. When you occur to can now not persuade people to buy your products, you is probably going to be going nowhere. Ever direct that presumably that missing share is sparkling easy programs to write persuasive copy to your customers? Might the trusty component standing between you and a powerful higher success be ethical lawful marketing copy? (click on industry sales letters and copy writing for more detailed recordsdata)

Reach Limitless Customers – Assign Limitless Charges!

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Manual Residential & Industrial Packages

Swiftly-Be conscious Enterprise Implementation Opinion

Reach Get entry to To Complete Packages for

Staunch Property Appraisal For Residential & Industrial Property Tax Charm: Property Tax Consulting Direction

**Detailed Enterprise E-Book**

Free Staunch Property Appraisal & Property Tax Manual eBook Enterprise Overview Details

Click on Upper Left Field To Get entry to

Click on Upper Left Study More For Free

Get entry to

It’s lawful to retain friendly members of the family with the tax assessor since one can

re-attraction their case as assuredly as is required with contemporary proof any time

one day of the year and safe. That case in total is a residential or commercial

property tax attraction.

HELPING OVER-ASSESSED VICTIMS

Prepare for those months. EXTREMELY PROFITABLE since few if any property tax advisor experts likely work within your zip code.

COMPLETE PROPERTY TAX CONSULTING COURSE

Tax Manual Direction a Swiftly-Be conscious Enterprise Implementation Opinion

Reach Get entry to To The Complete Direction: Property Tax Consulting Direction

100% newbie friendly – no tech abilities or trip needed.

Bank 4 figures in contingency commissions per attraction even whilst you occur to’ve NEVER made a dime consulting.

The top doubtless & FASTEST device to build contingency commissions helping the over-assessed.

EARN as you learn property tax attraction consulting.

Situation your maintain contingency bills.

Get Plump-Get entry to to a foolproof turnkey machine on easy programs to Successfully Charm Property Taxes and cash into the money virtually each time you grasp on a consumer.

Taking the Property Tax Manual Enterprise Direction will let you uncover easy programs to dominate an replacement With Cramped to No Competition.

Sight easy programs to build wide contingency bills, even one-time equalization processing bills from prospects and bag Multi-Referrals.

Earning LARGE FINANCIAL REWARDS finding out as you tear by a step-by-step project & constructing a Property Tax Review Enterprise.

Earning likely a couple of thousand greenbacks on every prospect by merely taking part on their behalf in a property tax attraction.

-

Mighty earning potential

-

Plump or portion-time industry opportunity

-

Superior marketing fabric

-

Limitless & highly centered leads easy to manufacture

-

No particular alternate trip needed

-

Nationwide alternatives

Customer Opinions:

I graducated with a diploma in Staunch Property (Jap Michigan University) and this direction used to be a wide Staunch Property Appraisal direction, better than in Faculty.

Thanks. Paul S

Purchased your Property Tax Manual direction closing year and ethical as you predicted we are neatly in our device to a wholesome six resolve earnings. My partner and I created a CRM utility (JASO)- to project our pipeline in a seamless vogue (from client intake to productivity prognosis) – this databases has been key to us in touching inappropriate with our customers on a timely manner apart from organizing every ingredient of our industry – we seek the payment that JASO has been for us and take a look at how precious this is succesful of be for other Property Tax Consultants alike.

For the time being the utility is adapted for Florida alternatively we are updating and customizing the CRM utility to be relevant nationwide. We might perhaps perhaps presumably decide on to market our product to your distribution listing; if lets focus on more intensive on the subject, I feel about we are succesful of reach to an notion that is priceless for all occasions enthusiastic, I gaze forward to hearing from you quickly. Bear an fair day and a pleasant weekend.

Sincerely, Michelle M

I the truth is feel such as you are offering a precious service to owners across The US. Assessors all the device by the nation raised property taxes within the development years and are if truth be told abhor to minimize them. Every thinking house proprietor must gaze carefully at their taxes, apathy can payment them allot of cash.

Pat F

Gilbert Az

![]() Folks reluctantly shell out over $1,000’s of bucks for attorneys and reliable property tax appraisers to symbolize them in describe to attraction their property tax without a guarantee of success or winning. A property tax advisor is a existence saver! It costs the patron virtually nothing to assess their alternatives.

Folks reluctantly shell out over $1,000’s of bucks for attorneys and reliable property tax appraisers to symbolize them in describe to attraction their property tax without a guarantee of success or winning. A property tax advisor is a existence saver! It costs the patron virtually nothing to assess their alternatives.

Charges are charged on a contingency foundation, meaning, whilst you occur to lose the case, the patron dangers nothing. Since there is no likelihood to the patron or house proprietor, they wish your service. Discovering potential purchasers is mind-blowing easy. Some price an up-entrance session price. Many set.

Principally, the real estate appraisal machine is rife with errors. Valuations are continuously in flux and the tax assessors bid of job hardly ever does internal most valuation visits. They proceed it to other blanket assessor services and products. Right here’s ethical the tip of the iceberg and it opens the door for a industry opportunity that undoubtedly helps others in a serious device.

When a valuation for an jurisdiction is required, town models out on a public instruct and in total the lowest bidding property valuation dealer wins. It’s top to have the choice to wager your bottom dollar that the dealer who won the instruct wishes to make a income.

Cramped time and money is allotted on a per unit foundation for the appraisal. Every so assuredly a raw crew is doing the work. There are time restraints on his crew in describe for the mass reports dealer to build his income. Errors are rampant. Therefore a dire want for appealing over-evaluate errors.

Serving to owners apart from commercial accounts lower their property tax is a reliable industry that generates financial rewards.

These days, other folks that might perhaps perhaps presumably use some extra earnings can work this service as a work-from-house primarily based mostly industry or an add on portion-time industry.

Since there is no free lunch, it can perhaps presumably presumably be worked along with any other earnings stream such because the mortgage brokerage alternate, real estate, insurance and the same consulting industries. It will likely be worked one day of leisurely cases or ethical to set one thing tough and various to wait on flip the desk by helping fair regulatory errors.

Residential Property Tax Charm Faculty

Residential Property Tax Charm Faculty

Residential property tax attraction alternatives abound. That it is doubtless you’ll presumably presumably obtain you will by no manner bustle short of finding unsuitable assessments to fair now not to mention those referrals trying to minimize their property tax over evaluate.

Expert learn existing that the share of evaluate error exist is excessive.

It’s obvious as a bell that you just will by no manner lack purchasers.

So long as property taxes are levied and that real estate market valuations fluctuate, you will obtain an over-abundance of cases the build the evaluate valuation against a house proprietor is flat out execrable. Championing that tax attraction is an opportunity to be of wide service.

The bigger the tax invoice, the bigger the reward.

Industrial Property Tax Assessment Training

Industrial Property Tax Assessment Training

The commercial aspect of the industry deals with higher properties and, unnecessary to teach, higher commissions. Industrial valuations are in accordance with an Earnings System. In the occasion that they build much less win earnings than the outdated year, their property tax evaluate wishes to be much less. You’ll be succesful of learn about the alternatives that exist in this house of specialization.

Strip malls lacking tenants might perhaps perhaps presumably well like to attraction an primitive evaluate. Condo house and complexes vacancies, many miniature to medium firms that would be struggling might perhaps perhaps presumably presumably file appeals when the facts warrant. One more time, a industry valuation relies mostly now not on a Market Price System but on an Earnings System.

Truth is, in disagreement to residential properties which use a comparable property manner, a commercial property valuation is made on an earnings foundation. And bet what? If cash trek to the commercial property is lacking industry or tenants, you would favor found out a client who might perhaps perhaps presumably presumably use indispensable financial savings!

Give others the tax destroy they deserve. Provide a service the build practitioners are scarce and the outcomes are precious.

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Manual Residential & Industrial Packages

Swiftly-Be conscious Enterprise Implementation Opinion

Reach Get entry to To The Complete Packages for Residential & Industrial Property Tax Charm:

Property Tax Consulting Direction

Your first Guarantee: That it is doubtless you’ll presumably presumably like TWO full months to hunt every part, use what you to come to a decision on, and, if for any motive or even no motive, you to come to a decision on a full refund, ethical return every part and that that you just can presumably bag your money abet without lengthen. NO questions requested. You don’t desire a ‘my canine ate my homework listing’. No person will ask you any questions in any respect. No ache. No ‘elegant print’. Easy and simple; you are extremely pleased with what you bag or you bag a full refund. I’m devoted to the just of most absorbing having overjoyed customers. When you occur to is probably going to be now not going to income from having my Machine, I the truth is would decide on to buy it abet.

My sole just in offering this direction is for bringing social justice to those over-assessed. To fair wrongs. Many tax assessors ogle their job as maintaining the tax inappropriate and have to now not pro-packed with life in helping over-assessed victims. The reality is that over-evaluate errors are excessive and decide on to be addressed. Assessment bureaucrats must be proven the facts and if they flip a blind seek, there are two more avenues of attraction: The Municipal Charm and the Impart Charm. We decide on activists who will stand up against the bureaucrats and with the trusty proof, you will safe.

I want you to position quite so a lot of of thousands of bucks into your financial institution legend all the device by the following ten or twenty years with this reliable Property Tax Consulting Home Consulting Direction.

LEGAL: Whereas it has been proven by quite so a lot of our customers that you just would make cash very rapid with this recordsdata,

please take into accout the reality that what you are shopping is mainly INFORMATION and never a promise of riches or financial create.

What you set with this recordsdata is as a lot as you.